Sustainable Development Goals

The 17 Sustainable Development Goals (SDGs) and targets associated adopted by all the Member States of the United Nations in 2015, present an agenda designed to achieve economic, social, and environmental progress for the year 2030.

At Acceso Crediticio we align our business to the Objectives of Sustainable Development to add efforts on the issues prioritized by the member nations and thus be able to meet the goals established for the sustainability of the planet, contributing to the well-being of current generations and future ones.

Acceso Crediticio´s activities have a particular impact on seven of the goals:

Corporate Sustainability Policy

Corporate Governance

At Acceso we operate under the principles of good corporate governance, which includes risk management through the company’s policies, rules and internal bodies, through which the management of each business unit is directed and controlled. Among our good corporate governance practices are through which the management of each business unit is directed and controlled. Among our good corporate governance practices are through which the management of each business unit is directed and controlled. Among our good corporate governance practices are

Likewise, there is fairness in the treatment of all members of the organization: shareholders, officers, employees, collaborators, clients and any member of the company.

Audit Committee

Risk Committee

Remuneration

Committeei

PLAFT Committee

Business and Strategy

Committee

Asset and Liability

Management Committee

Sustainability Committee

Stakeholders

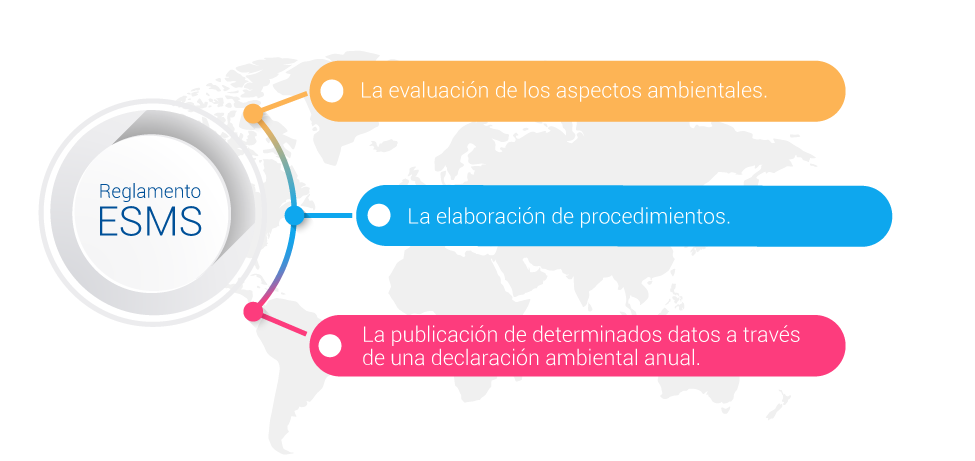

Environmental and Social Risk Management System (ESMS)

Acceso Crediticio has implement an Environmental and Social Risk Management System framed within the a Environmental and Social Management System (ESMS) regulation.

The ESMS Regulation is a management tool used to assess, understand, and improve environmental activity. This regulation establishes a series of requirements, including:

With the insertion of an environmental management system, Acceso Crediticio pursues the following objectives:

The implementation of the environmental management system was carried out during the following periods: 2019, 2020 and 2021.

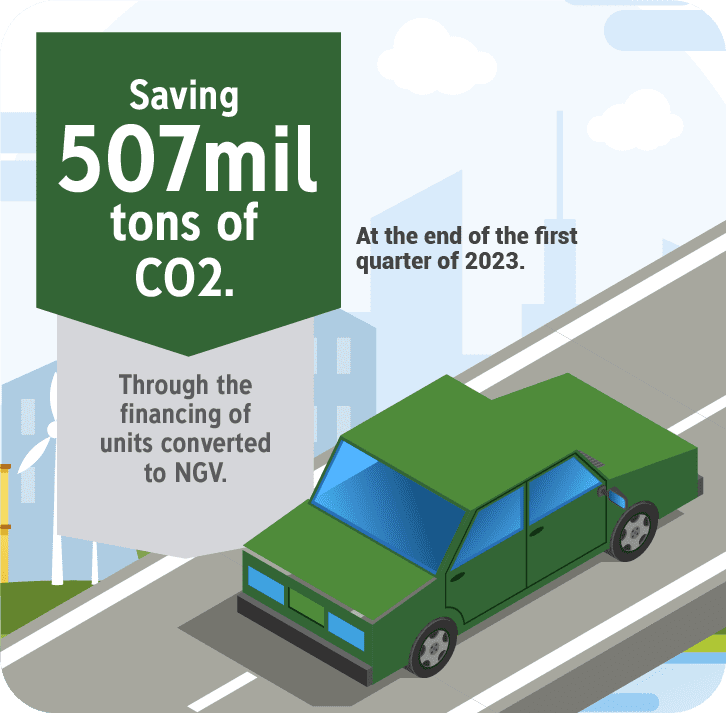

Reduction of Carbon Dioxide Emissions (CO2)

Co2 x Km Traveled*

Osinergmin study:

http://www.osinergmin.gob.pe/seccion/centro_documental/Institucional/Estudios_Economicos/Libros/Libro-Industria-Gas-Natural-Peru-10anios-Camisea.pdf

| Year | Annual Taxi Placement | Emissions Saved x Year (TON) |

|---|---|---|

| 2019 | 4935 | 12,872.06 |

| 2020 | 2527 | 19,463.28 |

| 2021 | 1930 | 24,497.34 |

| 2022 | 581 | 26,012.78 |

| 2023 | 50 | 26,143.19 |

Corporate Social Responsibility Activities

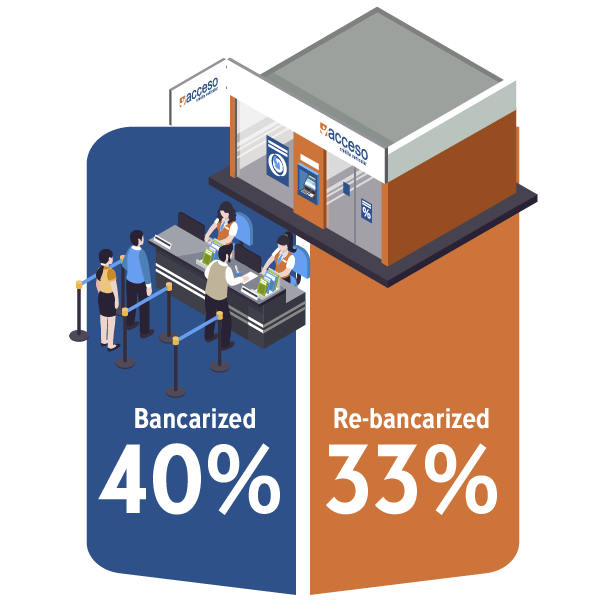

We offer vehicle financing options for customers located at the base of the economic pyramid, who do not have access to the traditional financial system, committed to reducing social gaps through banking and formalization, reflecting an adequate credit history.

Seeking to be independent and owners of their own businesses, hundreds of Peruvian women have found an opportunity for development through the purchase of vehicles. In 2021, more than 50% of the total vehicle loans granted by Acceso were obtained by women.

Our inclusive policy provides all our clients with the security of equal treatment when applying for a vehicle loan. And through our campaigns we provide facilities so that more entrepreneurial women can join the workforce and be part of the 37.3% of Peruvian women who currently work in a productive activity and are managers of their own employment, according to the latest report of the National Institute of Statistics and Informatics.

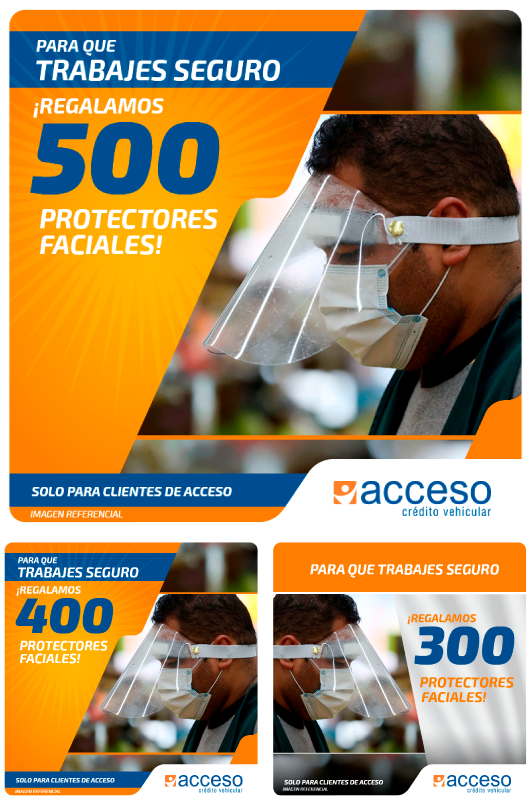

As part of our commitment to help our community as a security measure for our taxi customers, 900 facial protectors were delivered in order for them to be able to continue operating given the emergency situation developed due to the COVID – 19 pandemic. The aim was to prevent the spread of Covid-19 in the transportation service.

At Acceso we are committed to reducing the impact that we generate as a company. For this reason we promote a culture of segregation and recycling of electrical appliances and electronic devices (EEE) that have reached the end of their useful life, either due to internal procedures or because they have broken down. These are obtained from the equipment renewals collected from our collaborators. This helps promote the correct use of electrical and electronic equipment (cell phones, modems, routers, decoders, headphones, etc.)Because of this, Acceso has received recognition from a telephone company for the implementation of adequate infrastructure in the correct valuation and final disposal of unusable waste, obtaining the Recycle 2020 Distinction.

Smart Campaign

Last News

23/11/2021

We share the link:

https://www.fpcmac.org.pe/protocoloverde